Owner-operator coverage, a specialized collision insurance product for independent truckers, is crucial in managing risks associated with commercial vehicle operation. It offers comprehensive protection including liability, physical damage, medical payments, and cargo/personal effects coverage. Partnering with insurers specializing in this area provides tailored policies at competitive rates, leveraging industry knowledge to mitigate risks like liability issues, cargo loss, and vehicle damage. Selection should balance protection needs with business financial health, with streamlined claims processes and personalized assistance offered by specialists for enhanced peace of mind.

“In the world of trucking, ensuring comprehensive protection is paramount, especially for independent operators navigating complex roads. This article guides you through the intricacies of owner-operator coverage and highlights the advantages of partnering with insurers specialized in this niche.

From understanding collision insurance for independent truckers to selecting the ideal plan, we offer a detailed look at these key aspects. Learn how specialists can enhance claims support, providing peace of mind on the road. Discover the benefits that come from tailoring your insurance to fit your unique needs as an owner-operator.”

Understanding Owner-Operator Coverage: A Comprehensive Guide

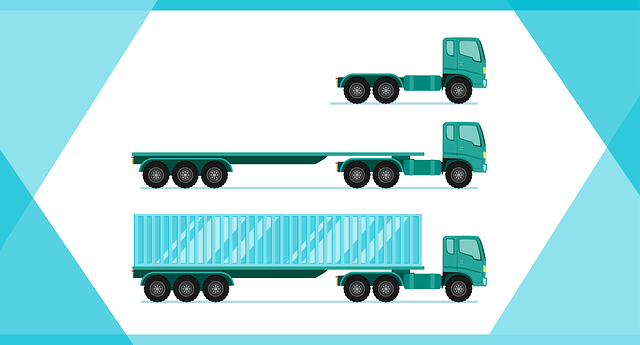

Owner-operator coverage, a specialized insurance product designed for independent truckers, is an essential component in managing risks associated with operating commercial vehicles. This type of insurance goes beyond basic collision insurance, offering comprehensive protection tailored to the unique needs of owner-operators. It includes liability coverage for any accidents caused by your vehicle, as well as physical damage protection, ensuring you’re covered if your truck is damaged in a collision.

Owner-operator policies also typically include medical payments and no-fault benefits, which can help cover healthcare expenses and lost wages for you and your passengers in the event of an accident. Additionally, these policies often provide coverage for cargo and personal effects within the vehicle, offering peace of mind while transporting valuable goods. Understanding these coverage options is crucial for independent truckers to make informed decisions and ensure they have adequate protection on the road.

Benefits of Partnering with Specialized Insurers for Truckers

Partnering with insurers who specialize in owner-operator coverage offers several significant advantages for truckers. These specialists provide tailored collision insurance for independent truckers, addressing their unique needs and risks associated with operating commercial vehicles. By working with such insurers, truckers can benefit from customized policies that account for factors like specific vehicle types, driving histories, and usage patterns.

Specialized insurers often have in-depth knowledge of the industry, enabling them to offer more comprehensive coverage options at competitive rates. They understand the challenges faced by owner-operators, including potential liability issues, cargo loss, and damage to vehicles, and design their policies to mitigate these risks effectively. This partnership ensures that truckers have access to robust protection, enhancing peace of mind on the road and allowing them to focus on safe and efficient operations.

Choosing the Right Insurance Plan: Factors to Consider

When selecting an insurance plan for your trucking business, it’s crucial to consider several factors to ensure adequate protection as an owner-operator. One key aspect is understanding the scope of coverage offered by different policies. Collision insurance for independent truckers is essential to mitigate financial risks in the event of accidents or vehicle damage. Look for a plan that includes comprehensive collision coverage, which protects against various incidents on the road, from fender benders to more severe collisions.

Additionally, evaluate the deductibles and limits associated with each policy. Higher limits provide greater protection but may come at a higher cost. Consider your business’s financial health and risk tolerance when deciding on these parameters. Remember to read the fine print to comprehend what is covered and excluded in each plan, ensuring you make an informed decision that aligns with your specific needs as an owner-operator.

Navigating Claims and Support: What to Expect from Specialist Insurers

Navigating claims and support is a crucial aspect when partnering with insurers who specialize in collision insurance for independent truckers. These specialists are equipped to handle complex scenarios that often arise from owner-operator operations. With their expertise, expect streamlined processes for filing claims, offering prompt responses to inquiries, and providing personalized assistance tailored to the unique needs of independent trucking businesses.

Specialist insurers ensure that every step of the claim management process is transparent and efficient. They offer 24/7 accessibility, enabling quick decision-making during emergencies. Additionally, they provide resources for risk mitigation, safety training, and regular updates on industry regulations, ensuring compliance and peace of mind for owner-operators.

Partnering with insurers who specialize in owner-operator coverage offers independent truckers a robust safety net, providing comprehensive protection tailored to their unique needs. By choosing these specialists, you gain access to enhanced claim support and a deeper understanding of collision insurance for independent truckers. This specialized approach ensures that should the unexpected occur, you’ll have the resources needed to navigate any challenges with confidence.