Owner-operators in trucking need robust physical damage coverage, especially through specialized collision insurance, to protect their investments and maintain operational continuity. Comprehensive truck protection goes beyond standard collision insurance by offering tailored repair and replacement services for various incidents like accidents, natural disasters, theft, or vandalism. By selecting policies that align with specific needs, owner-operators can access affordable vehicle damage insurance, ensuring peace of mind while confidently traversing the open road.

Empowering owner-operators to navigate physical damage coverage confidently is essential in mitigating risks and ensuring business continuity. This article serves as a comprehensive guide, addressing key aspects of understanding and managing risk. We delve into the intricacies of collision insurance for independent truckers, exploring different policy types like comprehensive truck protection and affordable vehicle damage insurance. By understanding tailored physical damage policies, owner-operators can choose the right coverage, offering peace of mind and robust repair and replacement benefits.

Understanding Physical Damage Coverage for Owner-Operators

For owner-operators navigating the complex landscape of trucking insurance, understanding physical damage coverage is a crucial step in ensuring business sustainability. Physical damage coverage, often part of a comprehensive truck protection plan, serves as a safety net against unforeseen events that can leave vehicles damaged or destroyed. This includes collision insurance for independent truckers, which specifically addresses issues arising from accidents, providing repair and replacement coverage tailored to the unique needs of owner-operators.

By availing themselves of affordable vehicle damage insurance options, owner-operators can protect their investments and maintain operational continuity. Tailored physical damage policies go beyond basic coverage by offering extensive repair and replacement services, ensuring that fleet owners can swiftly address damages without the financial burden. This proactive approach allows them to focus on core business activities while staying confident in their ability to manage potential physical damage incidents.

Types of Collision Insurance for Independent Truckers

Owner-operators looking to protect their investment and navigate potential physical damage scenarios can turn to various types of collision insurance designed specifically for independent truckers. These policies offer comprehensive truck protection, ensuring that repairs or replacements are covered in the event of an accident or other damaging incidents.

Collision insurance for independent truckers typically includes affordable vehicle damage insurance options tailored to meet the unique needs of owner-operators. Unlike standard auto insurance, these policies provide repair and replacement coverage, safeguarding against significant financial burdens often associated with physical damage to commercial vehicles. With access to tailored physical damage policies, owner-operators can confidently hit the road, knowing they have robust protection in place for their trucks.

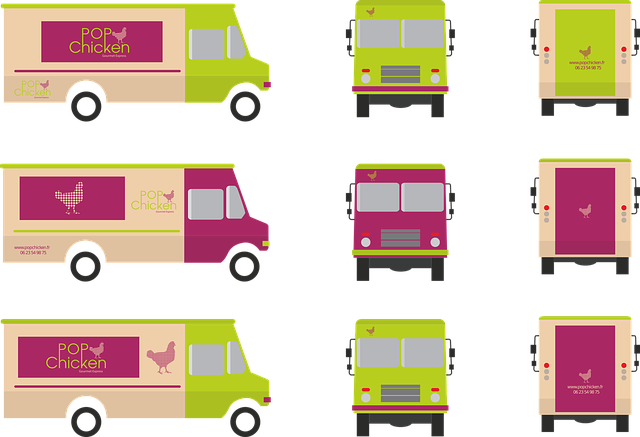

Comprehensive Truck Protection: What It Covers and How to Choose the Right Policy

Owner-operators looking to protect their investment in their trucks should consider Comprehensive Truck Protection (CTP). This type of insurance goes beyond standard collision insurance, offering a tailored physical damage policy that covers various scenarios. CTP includes repair and replacement coverage for your truck in case of accidents, natural disasters, or other incidents not covered by basic liability insurance. It can also provide protection against theft and vandalism.

When choosing a comprehensive truck protection policy, it’s crucial to compare different options based on the level of coverage they offer. Look for policies that include provisions for both major and minor damages, as well as optional add-ons for specialized needs like cargo protection or roadside assistance. Affordable vehicle damage insurance doesn’t have to compromise quality; by selecting a policy tailored to your specific needs, owner-operators can gain peace of mind while confidently navigating the road ahead.

Affordable Vehicle Damage Insurance: Tailored Policies for Peace of Mind

For owner-operators navigating the complex world of trucking, ensuring comprehensive physical damage coverage is a cornerstone of strategic risk management. However, cost often emerges as a significant barrier, especially for independent truckers with tight margins. This is where Affordable Vehicle Damage Insurance steps in as a game-changer. These tailored policies are designed to offer peace of mind by providing repair and replacement coverage for collisions, accidents, or natural disasters, without breaking the bank.

By understanding the unique needs of owner-operators, insurance providers craft physical damage policies that cover not just the financial burden of repairs but also the cost of replacing damaged or lost equipment crucial for operations. This includes tailored options for various vehicle types and cargoes, ensuring independent truckers are protected no matter their fleet size or specific hazards they face on the road. The result? Owner-operators can confidently hit the roads with the assurance that their investment is secured, allowing them to focus on what truly matters: safe and efficient transportation.

Empowering owner-operators to confidently navigate physical damage coverage is key to ensuring their business’ resilience. By understanding the nuances of collision insurance, choosing the right comprehensive truck protection, and accessing affordable vehicle damage insurance tailored to their needs, independent truckers can mitigate risks effectively. These strategic decisions not only provide peace of mind but also foster a smoother operational landscape, allowing them to focus on what matters most: the road ahead.