Owner-operators face unique risks requiring specialized physical damage coverage, including collision insurance and comprehensive truck protection. Partnering with insurers specializing in owner-operator coverage provides tailored physical damage policies offering affordable vehicle damage insurance with repair and replacement coverage for accidents, theft, natural disasters, etc. This peace-of-mind solution safeguards assets and keeps trucking operations running smoothly.

Partnering with insurers who specialize in owner-operator coverage is a strategic move for navigating the unique risks faced by independent truckers. In this article, we delve into the understanding of the specific needs of owner-operators regarding physical damage coverage, exploring the benefits of specialized insurers. We discuss various types of collision and comprehensive insurance options tailored for truckers, and provide insights on accessing affordable and customized vehicle damage insurance policies that offer robust repair and replacement coverage.

Understanding the Unique Needs of Owner-Operators

Owner-operators face distinct challenges compared to traditional employees, making their specific needs for insurance coverage crucial to address. They often own both their vehicles and equipment, requiring comprehensive protection against various risks, including physical damage. Unlike company drivers, owner-operators are personally liable for any accidents they cause, underscoring the importance of collision insurance that covers not just the vehicle but also potential legal costs.

Understanding these unique circumstances, insurers specializing in owner-operator coverage offer tailored physical damage policies that include repair and replacement coverage. Such policies ensure that owner-operators have access to affordable vehicle damage insurance, protecting them from significant financial burdens resulting from accidents or other unforeseen events. This specialized coverage is vital for independent truckers who need reliable protection without breaking the bank.

The Benefits of Specialized Insurers for Physical Damage Coverage

Partnering with insurers who specialize in owner-operator coverage brings significant advantages for individuals in the trucking industry. These experts offer tailored physical damage policies that cater specifically to the unique risks faced by independent truckers. Unlike general insurance providers, they provide comprehensive truck protection, including collision insurance and affordable vehicle damage insurance options, ensuring that owner-operators are financially secured against unforeseen events.

Specialized insurers offer repair and replacement coverage, which is crucial for navigating the high costs associated with physical damage to trucks. This level of customization means owner-operators can access tailored solutions that meet their specific needs, without overpaying for additional coverage they may not require. By choosing a specialist, truckers gain peace of mind, knowing they have robust protection in place should an accident or incident occur.

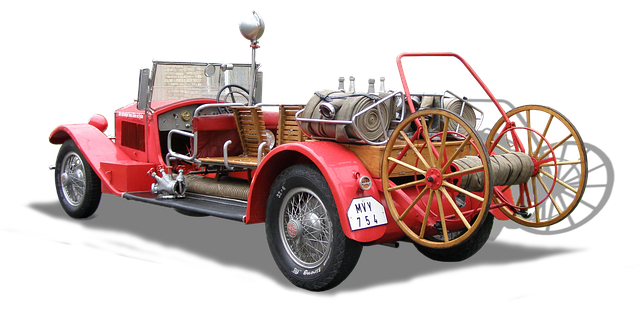

Types of Collision and Comprehensive Insurance for Truckers

For truckers, ensuring the right insurance coverage is paramount to protect their assets and maintain operational continuity. Physical damage coverage owner-operators rely on plays a dual role, offering both repair and replacement coverage for vehicles involved in accidents. This extends to two primary types: collision insurance and comprehensive truck protection. Collision insurance specifically covers damages arising from accidents with other vehicles or fixed objects, providing financial assistance for repairs or total vehicle replacement if necessary.

Comprehensive truck protection, on the other hand, goes beyond collision, encompassing a broader range of risks including theft, natural disasters, vandalism, and damage from hazardous conditions. This tailored physical damage policy is particularly beneficial for independent truckers who operate their own fleet, offering them affordable vehicle damage insurance that adapts to their specific needs and protects them from unexpected events that could cripple their operations.

Accessing Affordable and Tailored Truck Damage Insurance Policies

Accessing Affordable and Tailored Truck Damage Insurance Policies is now easier than ever for owner-operators. Specializing in physical damage coverage, insurers offering collision insurance for independent truckers provide comprehensive truck protection that goes beyond standard policies. These tailored physical damage policies ensure repair and replacement coverage for various vehicle damages, from minor fender benders to significant collisions.

By partnering with such insurers, owner-operators gain access to affordable vehicle damage insurance designed specifically to meet their unique needs. This specialized coverage offers peace of mind, ensuring that in the event of an accident or other unforeseen events, the financial burden is minimized through swift and efficient repair processes.

Partnering with insurers who specialize in owner-operator coverage offers a tailored solution for unique risks. By understanding the specific needs of these professionals, specialized providers can offer competitive rates on comprehensive collision and comprehensive insurance policies, ensuring access to affordable physical damage coverage. This approach guarantees that owner-operators have robust repair and replacement coverage, providing peace of mind on the road.