Independent truck drivers require specialized physical damage coverage and collision insurance to navigate unique risks on the road. Comprehensive truck protection offers tailored physical damage policies with repair and replacement coverage for trucks and their loads, minimizing financial losses and providing peace of mind. By choosing these policies, owner-operators gain access to affordable vehicle damage insurance, ensuring operational continuity and safe goods delivery.

“In the vast landscape of trucking, independent owners-operators face distinct challenges. This article delves into the unique risks they encounter on the road and explores essential insurance options to safeguard their investments. From physical damage coverage protecting their vehicles to specialized collision insurance and comprehensive truck protection plans, we guide drivers in navigating these complex choices. Discover tailored policies that offer peace of mind, ensuring repair and replacement services for a secure trucking experience.”

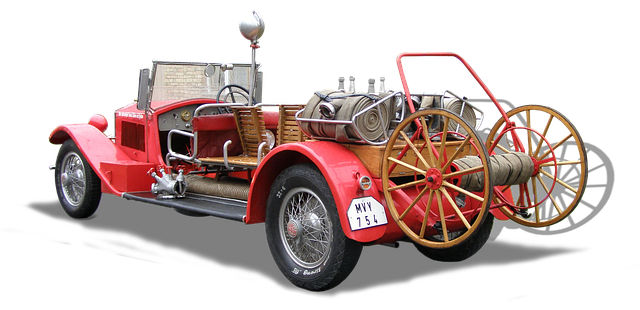

Understanding the Unique Risks of Independent Truck Drivers

Independent truck drivers face unique risks on the road that require specialized coverage. Unlike company drivers, owner-operators are responsible for their vehicles and loads, which means they bear the brunt of any damage or loss. This is where tailored physical damage policies become essential. Comprehensive truck protection should include collision insurance designed specifically for independent truckers, ensuring they’re covered in the event of a crash.

Additionally, repair and replacement coverage is crucial to help owner-operators manage unexpected vehicle breakdowns or accidents that could lead to significant financial losses. Affordable vehicle damage insurance options that offer comprehensive protection are available, allowing drivers to focus on delivering goods safely while mitigating potential risks.

Physical Damage Coverage: Protecting Your Investment

Independent truck drivers face unique challenges when it comes to insuring their vehicles, especially when considering physical damage coverage. Owner-operators often juggle tight margins and unpredictable expenses, making it crucial to have a tailored physical damage policy that offers comprehensive protection at an affordable rate. This is where specialized insurance providers step in, offering collision insurance for independent truckers designed to cover the costs of repair or replacement due to accidents or other damages.

A tailored physical damage policy should include repair and replacement coverage for various vehicle components, ensuring drivers aren’t left with a substantial financial burden after an incident. By choosing an affordable vehicle damage insurance plan, owner-operators can safeguard their investment, maintain operational continuity, and focus on the road ahead with peace of mind.

Collision Insurance Options for Independent Truckers

Independent truck drivers face unique risks on the road, which is why having adequate collision insurance is essential. Many traditional insurance policies may not offer the comprehensive protection needed to cover the costs associated with accidents or vehicle damage. Physical damage coverage specifically designed for owner-operators is crucial in mitigating these risks. These tailored physical damage policies provide peace of mind by offering repair and replacement coverage for both the truck and its load.

Collision insurance for independent truckers goes beyond basic liability coverage, addressing the potential for significant financial losses due to accidents. Affordable vehicle damage insurance options are available that cater to the specific needs of this workforce. By choosing a policy with comprehensive truck protection, drivers can ensure they are prepared for unexpected events on the highway, minimizing the financial impact and enabling a smoother recovery process.

Comprehensive Truck Protection: Tailored Policies for Peace of Mind

For independent truck drivers, having the right comprehensive truck protection is paramount to navigating the unique risks inherent in their profession. While standard auto insurance policies often fall short, tailored physical damage policies specifically designed for owner-operators offer a safety net against unforeseen circumstances. These policies go beyond collision insurance for independent truckers, providing repair and replacement coverage that can shield against significant financial losses resulting from accidents or other incidents.

By opting for comprehensive truck protection, drivers gain peace of mind, knowing their vehicles are safeguarded against both major and minor damages. This includes physical damage coverage that kicks in during collisions, as well as optional add-ons for specific needs like cargo loss or theft. With affordable vehicle damage insurance tailored to meet the unique demands of independent trucking, drivers can focus on the road ahead, confident that they’re protected at every turn.

Independent truck drivers face distinct risks on the road, which is why having adequate insurance protection is paramount. By understanding the importance of physical damage coverage, exploring collision insurance options, and considering comprehensive truck protection tailored to their needs, owner-operators can navigate the challenges of the open road with peace of mind. With affordable vehicle damage insurance, repair and replacement coverage becomes accessible, ensuring that these essential workers are protected against unexpected events.